|

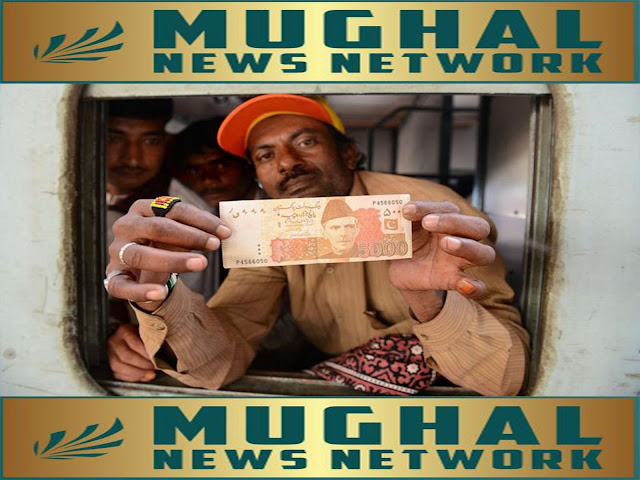

| What is demonetization and can scrapping the 5000 note improve Pakistan's economy? |

Pakistan's current economic crisis is unrelenting and with daily rising inflation and declining economic indicators every few weeks, many people seem to be asking the question of what is the permanent solution to this problem.

This question has been asked many times by economists in Pakistan for the last year, but only the traditional solutions come out, which are considered short-term solutions by some circles, but two days ago, in a podcast, the economist Ammar Khan has come up with an unconventional solution that is currently the talk of the town on social media.

Speaking to Shahzad Ghiyas, host of the podcast 'The Pakistan Experience', Ammar Khan described 'demonetization' as a way to formalize the Pakistani economy, legalize and formalize it and improve exports.

While speaking, he said that eight and a half trillion rupees are present in the country's economy, people have cash, and consumption is also taking place, but it is the money of the informal economy, which is not taxed but formal. The consumption of the economy is increasing and that is the problem. When money is out of the system, it cannot be used for productive purposes.

Ammar further said that if these eight trillion rupees come back to the banks, or let's say four or five trillion rupees, then you will have additional money that can be used. At this time the 5000 note needs to be demonetized, say after six months this note will not be valid. Many people will cry, but those who have five thousand notes will cry.

This will lead to people depositing money in banks. Use this money for the export industry.

In this podcast, he goes into more detail, saying that obviously there will be more questions about how most people in Pakistan don't have bank accounts, so this can be done immediately through an executive order.

"You have an excellent infrastructure in the form of the Benazir Income Support Program or Ehsaas through which you can then channelize this money to the people in a targeted manner," he said.

Many questions arise here and in this regard, the example of neighboring India is also in front of us, where Prime Minister Narendra Modi announced the abolition of Rs 500 and Rs 1,000 notes under a similar policy, almost nine years ago. was

Let's examine what demonetization is, what is its purpose, and whether it can be useful for the Pakistani economy or not.

What is demonetization and what is its purpose?

Demonetization is a process in which a government institutes a policy to eliminate certain bank notes from the economy.

Under this policy, the maturity of a particular banknote is fixed and the public is informed about how long the currency note will become unusable i.e. it will not be acceptable in the market.

The government formulates a policy under which people can deposit these notes in banks during this period. After that, the withdrawal of this amount is allowed, but the government imposes some conditions in this regard.

It is believed that big notes are commonly used in illegal activities like corruption, tax evasion, and smuggling and the main objective of demonetization is to eliminate corruption and tax evasion.

In addition, demonetization seeks to reduce currency notes in the economy so that people make payments through digital means more and more. It also helps in documenting the economy and collecting taxes and when more money is deposited in the banks, the government has the opportunity to make policies and use the money to give incentives to certain sectors.

How effective was demonetization in India?

Indian Prime Minister Narendra Modi announced the demonetization of Rs 500 and Rs 1000 notes in his address to the nation on November 8, 2016, at 8 pm.

According to the Government of India, the aim of this policy was to eradicate fake notes and undeclared wealth.

A few hours after this announcement, i.e. at 12 midnight, these notes were devalued, but people were allowed to deposit them in their bank accounts and withdraw this amount only under certain conditions.

The purpose was said to be that people with large amounts of black money (money on which no tax is paid) would not deposit it in the bank for fear of legal action and thus lose the money. will

Analyst Vivek Kaul, writing for the BBC in 2017, called it a failed policy.

He wrote that according to the data, about 99 percent of the money that was "untaxed was deposited in the banks over the next few months, meaning that the objective of eradicating 'black money' could not be achieved."

Similarly, fake notes continued to exist in the economy even after demonetization and did not decrease.

During this time, the government's poor strategy was criticized and the difficulties faced by the common man were discussed.

Vivek Kaul wrote that "the government did not know how much black money existed in what form."

According to him, due to this policy, many people lost their jobs in the formal (informal) sector while the agriculture sector was also affected.

Another immediate effect of this policy in India came in the form of cash shortages when people queued up to show up outside.

This strategy of Narendra Modi was heavily criticized by the opposition parties, but some economists also believe that it must have brought far-reaching benefits to the Indian economy.

It should be noted that the Supreme Court of India declared this policy legal at the beginning of this year. After this decision, the policy was reviewed by several Indian journals and it was said that while the initial objectives of the policy could not be achieved, in the long run, it helped to 'formalize' the Indian economy. ' and people in the country were attracted to digital payments and 'there was an opportunity to digitize the economy.'

Can the process of demonetization in Pakistan be effective?

In the year 2016, when the demonetization policy was adopted in India, the Senate in Pakistan also suggested through a resolution that the 5000 rupee note should be abolished to stop the flow of illegal money and the formal economy of Pakistan. Not paying taxes can be limited.

However, at that time Pakistan's Ministry of Finance rejected the proposal saying that it would harm the business.

At that time, the government was of the view that instead of demonetization, the promotion of digital banking is a better solution for which efforts are being made.

It should be noted that the five thousand rupee note is the largest banknote of Pakistani currency, which was first issued in 2006.

On the other hand, despite the efforts of all the governments of Pakistan, the tax payment rate in Pakistan is less than ten percent, which is attributed to the informal economy.

Economist Sana Tawfiq while talking to BBC said that it will not be of any particular benefit to the Pakistani economy.

He said that 'Take the example of India, there too the main objectives of demonetization could not be fulfilled and on the contrary, it had an impact on the low-income people.'

Sana Tawfiq said that "Until the things that are urgently needed in Pakistan regarding digitization are not fulfilled, there will be no benefit in bringing such a policy."

He said that people who are not taxed in Pakistan have the most wealth, so even if you demonetize, they have options to convert this money into another asset. .'

Sana Tawfiq said that there is a need in this regard to tax this segment and implement it strictly, similarly in the real estate sector where most of the payments are made in cash. Go and document this sector.'

He further said that there is a need to work on an administrative basis in this regard. People in Pakistan do not have bank accounts. As long as you solve these problems, then demonetization can be thought about.

Economist Dr. Hadiya Saeed agreed with Sana Tawfiq and said, "The short answer is that if you look at the example of India, it will not be right to do this."

He said that the problems of Pakistan's economy are administrative, for the solution of which steps need to be taken.

Dr. Nadeem Javed, Chief Economist of the Ministry of Planning Commission, while talking to the BBC, said that "the main purpose of demonetization is to eliminate corruption, bribery or kickbacks and fake notes and black money."

"The government is already taking steps to demonetize all these things which can be talked about in a better way but demonetization doesn't give you a quick fix."

However, there were people on social media who supported him. Najam Ali wrote that the time has come to end cash transactions. Demonetization will end the culture of corruption in Pakistan.

Responding to them, PTI's Faraz Chaudhry said, "No policymaker will encourage demonetization, especially at a time when growth is so low."

"It is important and the future lies in digitization but in Pakistan, we need to take all steps slowly."